Principal represents the money you've borrowed to purchase your home and builds up in the form of equity as each monthly payment is made. Principal & Interest accounts for most of your monthly USDA loan payment. These calculations are based on your specific inputs, as described above. Our USDA loan calculator gives you the total estimated monthly payment and a monthly breakdown showing how your payment is calculated.

Still, you pick your insurance provider and can change insurers at any point in the future. Homeowner's insurance is usually included in your monthly mortgage payment for USDA loans. Property taxes are generally estimated to be 1.2% of the home's value but will vary depending on your location.Īnnual homeowner's insurance is typically 0.35% of the home's value. Typically, USDA loan terms are set for a period of 15 or 30 years. Loan term is the length of time you want to repay the loan. APR stands for "Annual percentage rate" and is used to help estimate your interest rate, including origination fees. Interest rate is the cost of borrowing money to purchase your home with a USDA loan. USDA loans don't require a down payment, but putting money down can reduce your starting loan amount. Home value is the total estimated purchase price of the home.ĭown payment is the amount of money you intend to pay upfront for the home at closing. Instead, there USDA loans have an upfront guarantee fee and annual fee, which you can see included in your calculation breakdown.

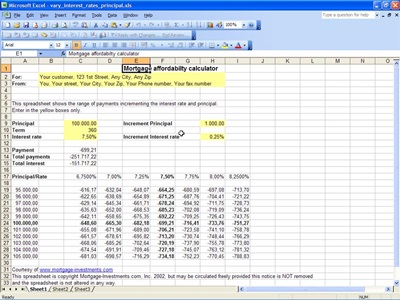

For example, USDA loans do not require a down payment or private mortgage insurance (PMI). USDA loans differ from other mortgage options, so this calculator is designed to account for the unique benefits and costs of using a USDA home loan. Our USDA loan calculator helps you estimate your monthly mortgage payments, including taxes and insurance, to give you a better idea of what to expect when financing your home purchase using the USDA loan program.

0 kommentar(er)

0 kommentar(er)